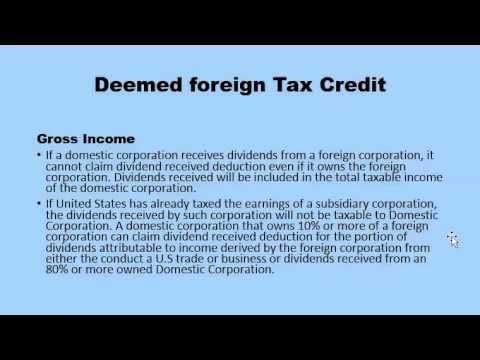

Hi folks, I'll be talking about access credit carryover today. If foreign tax credits exceed the limitation in a given taxable year, these can be carried back one year and forward up to ten years. Excess credits on general limitation income can offset only past all future access limitations on general limitation income. Foreign tax credits can also be used to offset the alternative minimum tax (AMT). The foreign tax credit is computed in the same manner as credit for regular tax purposes, with one exception. For regular tax purposes, the limitation equals the pre-credit US tax multiplied by the ratio of foreign source taxable income to worldwide taxable income, with separate limitations computed for passive category income and general category income. The same basic formula and separate income limitations apply for AMT purposes, except that the pre-credit US tax amount is now the tentative minimum tax before any foreign tax credits, and the foreign source and worldwide income amounts are computed on the basis of alternative minimum taxable income. Taxpayers have a choice to use simplified AMT foreign tax credit limitation when calculating their AMT foreign tax credit. The election to do so is made in the taxpayer's first tax year for which the taxpayer claims an AMT foreign tax credit. It then applies to all subsequent tax years and is only revocable with the consent of the IRS. Let's talk about deemed foreign tax credit gross income. If a domestic corporation receives dividends from a foreign corporation, it cannot claim a dividend received deduction, even if it owns the foreign corporation. Dividends received will be included in the total taxable income of the domestic corporation. If the United States has already taxed the earnings of a subsidiary corporation, the dividends received by such cooperation will not be taxable to the...

Award-winning PDF software

Individual amt credit carryforward 2025 Form: What You Should Know

The more items' deferral, the greater the AMT credit and the smaller the federal income tax liability. Form 8801 and Credit for Prior Year Minimum Tax — IRS The Alternative Minimum Tax (AMT) credit is available to taxpayers who have qualified property or income in 2018, or any prior year. Estate tax | Goethe estate may include income on the estate tax return, but it is generally not tax-free. The amount you are allowed to leave to your heirs depends on whether you itemize your deductions — in other words, whether you choose to claim your standard deduction or standard and itemized deductions. If you itemize, you can take advantage of up to 5.5 million in personal exemptions and up to 10.9 million in mortgage interest or real estate taxes if your estate is subject to an applicable local homestead exclusion. If you choose not to itemize, you're only allowed to leave 5.1 million in estate tax. You can still itemize, but there's no additional benefit. Form 1040EZ for Estate and Gift Tax Deductions May 29, 2023- This form, in addition to your standard 2-page form, also has 3 pages of exemptions and 10 pages for additional items like tax-free gifts and trusts and any other expenses. Form 1040EZ for Estate and Gift Tax Deductions — IRS The maximum exemption for an estate can be reduced by the decedent's surviving spouse or other dependent for the year of death and, once all tax is refunded, by any estate tax exemptions left at the close of the estate. Form 1040-EZ (Estate and Gift Tax Return) for Estate and Gift Taxes — IRS The first page of the final form lists the names and addresses of the decedent's decedents. Form 1040-EZ for Estate and Gift Taxes — IRS A common mistake in estate tax return preparation is not including the appropriate amounts for any itemized deductions, such as tax preparation fees and other expenses. These items of deduction, tax preparation fees and other expenses, including gift taxes, are due on the estate tax return, for which due date is December 31st of the year of death. The date should be listed under the 'Statement date' column.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 8801, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 8801 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 8801 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 8801 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Individual amt credit carryforward 2025