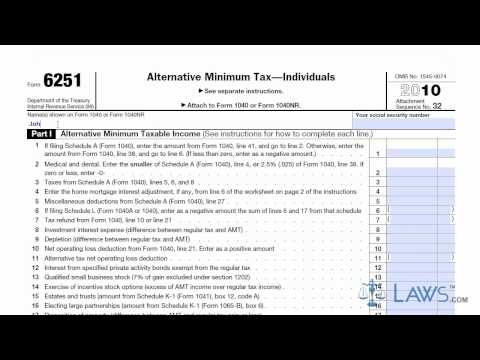

Laws calm legal forms guide form 6251 is a United States Internal Revenue Service text form filed by every individual taxpayer to determine if the taxpayer will pay standard income tax or the alternative minimum tax. The alternative minimum tax is a higher tax rate used for individuals or corporations over a substantial threshold. A form 6251 can be obtained through the IRS's website or by obtaining the documents through a local tax office. The form must be filed alongside your regular income tax form, which is the 1040 form for individual taxpayers. You will use the information on your 1040 to fill out form 6251. Because of the different types of 1040 forms, the location of the correct amounts will vary. For our example, we will be using the standard 1040 as our reference. Enter your name and social security number at the top of the form. Enter the amount on your 1040 line 41 on line one of the form 6251. Continue to enter the amounts taken from your 1040 on the appropriate lines if they are applicable. Leave blank any lines that do not apply to you. Enter medical and dental amounts, home mortgage interest amounts, deductions, investment interest, net operating loss, qualified small business stock, long-term contracts, or any other amounts that apply to part one and all of the amounts in lines one through 27. Enter this amount on line 28. This is your alternative minimum tax bill income. You are exempt from the AMT if the amount on line 28 is less than the amounts indicated in line 29 in part 2. If more, you must further complete part 2 to calculate your AMT amount by entering the appropriate amounts in lines 30 through 35. If you have capital gains during the tax year,...

Award-winning PDF software

Irs 2025 tax 6251 Form: What You Should Know

IRS Form 6251 is a tax measure that's been in effect since the mid-1990's by the Internal Revenue Service (IRS). The alternative minimum tax (AMT) is a separate tax that is imposed in addition to your regular tax. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Form 6251 is a self-assessment tax, usually made by taxpayers who are subject to the AMT and who would like to know what portion of an Alternative Minimum Tax (AMT) payment they are eligible for or will owe. It's a tax measure to help ensure that the tax you pay is as close as possible to the amount you owe. IRS Form 6251 is a self-assessment tax typically made by taxpayers who are subject to the Alternative Minimum Tax and who would like to know what portion of an Alternative Minimum Tax (AMT) payment they are eligible for or will owe. It's a tax measure to help ensure that the tax you pay is as close as possible to the amount you owe. Alternative Minimum Tax 2025 — Tax tips for people with high incomes Mar 16, 2025 — The alternative minimum tax (AMT or the AMT for short) is a tax measure that's also known as the graduated rate threshold test, and it is a tax on income. It's a separate income tax that's imposed on some taxpayers who qualify to be subject to the AMT and others who do not. The AMT is a tax on your income, rather than your type of income. It has to do with the top two tax rates on income: 15% and 28%. AMT 2025 rates • Taxpayers with income over 91,400 for single filers, 118,300 for joint filers, and 192,400 for married filing jointly, may be subject to the AMT • Taxpayers with income over 300,000 for single filers, 413,300 for jointly filers, and 441,700 for married filing jointly, may not be subject to the AMT • Taxpayers must pay AMT • Taxpayers are exempt from the AMT. Who qualifies for the AMT? • You must be a U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 8801, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 8801 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 8801 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 8801 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs 2025 tax form 6251